Recently, a lot of folks have reached out to us after reading our post about the 5 Documents You Need When Selling Your Mobile Home in Texas. Many people found the article really useful in navigating the steps needed to sell their used mobile home but had some more specific questions about mobile home taxes in Texas.

In this article, we will go into a bit more detail about the tax statement that the TDHCA requires from your County Tax Assessor-Collectors Office in order to transfer the title to the new buyer.

What Will You Need?

Typically, in a private sale of a mobile, the buyer and the seller will have to work out which party is going to submit the Application for Statement of Ownership (SOL) to the TDHCA. We usually recommend if your the buyer, you submit the application – just to make sure it gets done and the mobile home transfers into your name.

Along with the SOL, you will have to submit a record that the taxes on the mobile home are up-to-date. The standard record that the TDHCA uses is Form-1076. In short, you will need to go to your County Tax Assessor-Collectors Office and have them complete the form on your behalf. Once it’s completed, you will submit that form with your SOL to the TDHCA.

A couple of things we recommend when doing this:

First, call or email your Tax Assessor Collectors Office before you go. Many smaller counties only have one office, such as Comal County. However, many of the densely populated counties have multiple tax offices and there may actually only be one location that will handle mobile home taxes (this is the case in Bexar County). You can save yourself a lot of time if you go to the right office the first time…trust us!

Second, be sure to take a blank copy of Form-1076 with you. Mobile home taxes are rather niche and not everyone at the tax office will understand what it is you are looking. Having a blank copy will help them get you pointed in the right direction.

And lastly, just be aware that not all counties use Form-1076 but will have their own specific form that the TDHCA accepts. If this is the case, ask the Tax Assessor-Collector for an “18 month tax statement” or an “18 month tax certification”, specifically for a mobile home. Again, it will be handy to have a blank copy of Form-1076, just so folks know what you need.

What Taxes Have To Be Paid And When?

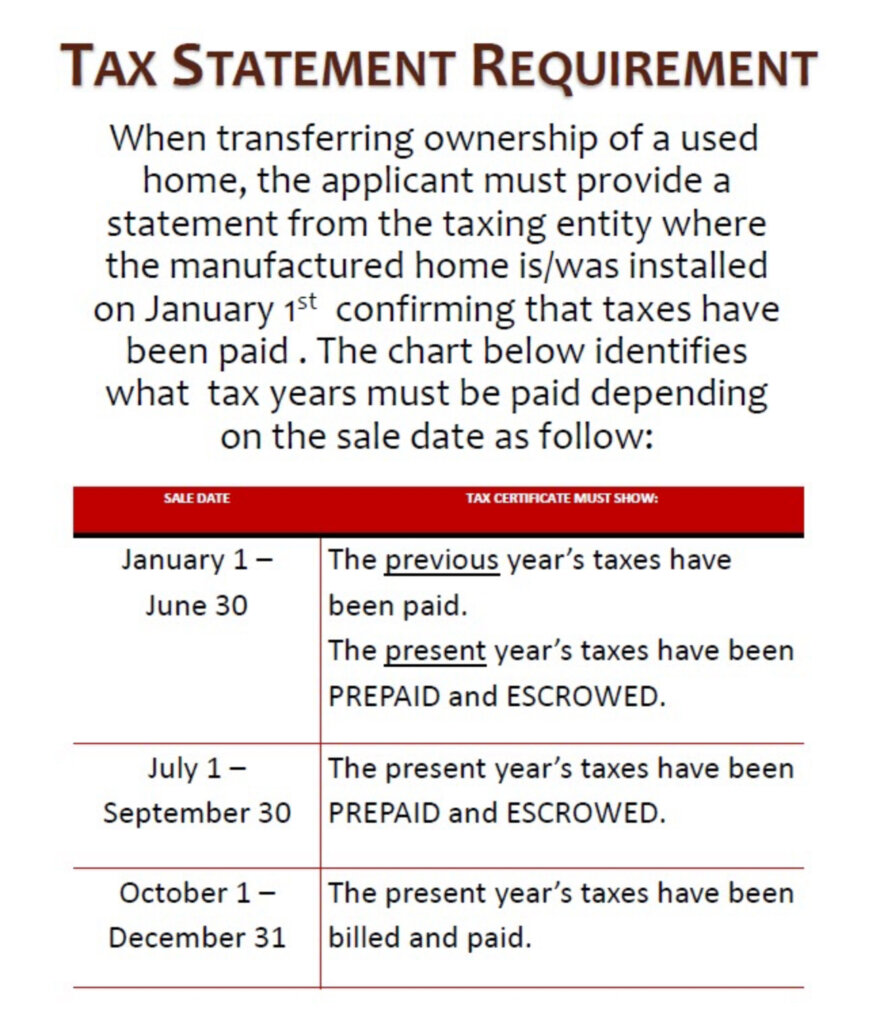

This is probably the part that causes the most confusion when dealing with mobile home taxes in Texas. Just bear with us and hopefully we can make things easier for you. First, we will start with a handy chart and then go into a little detail.

Just to help clarify, prepaid and escrowed means that the taxes owed on the home have been estimated, paid, and that the county will apply that payment when the final tax bill is determined, usually around October or November of the current tax year. To transfer a mobile home title in Texas, the taxes for the current year must either be paid in full or prepaid and escrowed. Also, don’t forget that any previous years’ taxes that haven’t been paid, will have to be paid as well, though there is an exception…

What If You Owe A Lot In Back Taxes?

It happens to the best of us. But you may be in luck. As of February 15, 2024 if you owe back taxes on your mobile home and there are recorded tax liens, the county is required to remove liens older than 4 years. There are some exceptions though, such as bankruptcy and certain tax deferments if they were taken.

Not all counties are up to speed on this, so we would definitely recommend taking this DOCUMENT with you!

Have Tax Liens Removed

One final thing, just to save you a trip to the Tax Assessor-Collectors Office. If you are getting up-to-date on your taxes and you had attached tax liens, it’s a good a idea to go ahead and ask that they be removed. This could potentially save you a trip if you find out later that there are still liens on the mobile home.

We really hope this guide is able to give you some direction in figuring out a rather small but really important step in transferring the title for your mobile home.

As always, feel free to reach out to Eric or Paul at 210-504-8388 or shoot us a message if you have any questions! Or if you would rather skip all the mobile home titling paperwork and mobile home tax legwork, we’d love to come look at your home and make you a a cash offer!