Selling a mobile home can feel impossible, especially if you have a mortgage on the property. However, it’s not impossible to sell your mobile home with a mortgage in Texas. With the right approach and guidance, you can successfully sell your mobile home and pay off your mortgage. In this blog post, we’ll discuss six tips Texas mobile home owners should know about selling a mobile home they own money on and how Journey Mobile Homes can help facilitate the process by providing a fast and direct sale.

1. Understand Your Mortgage

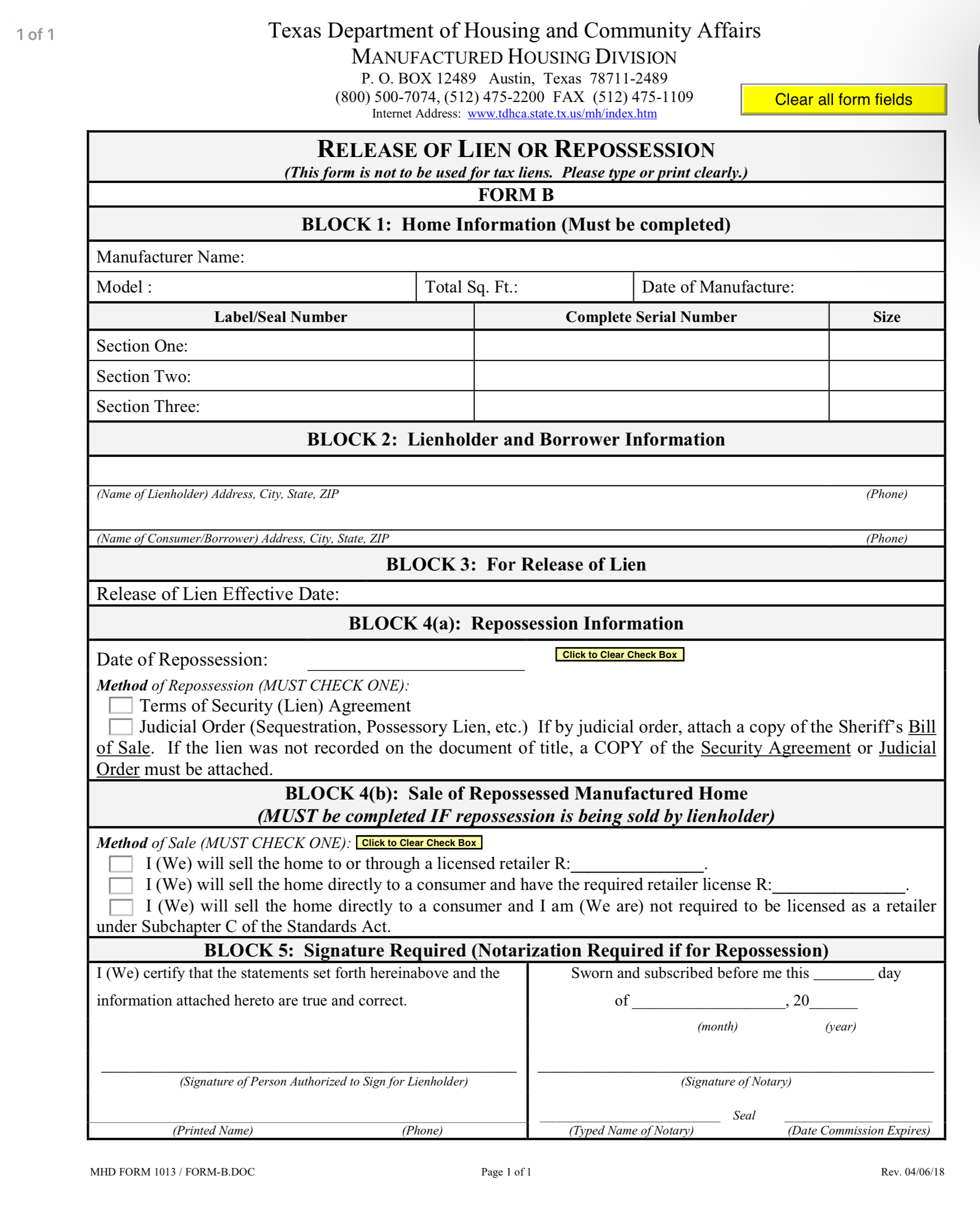

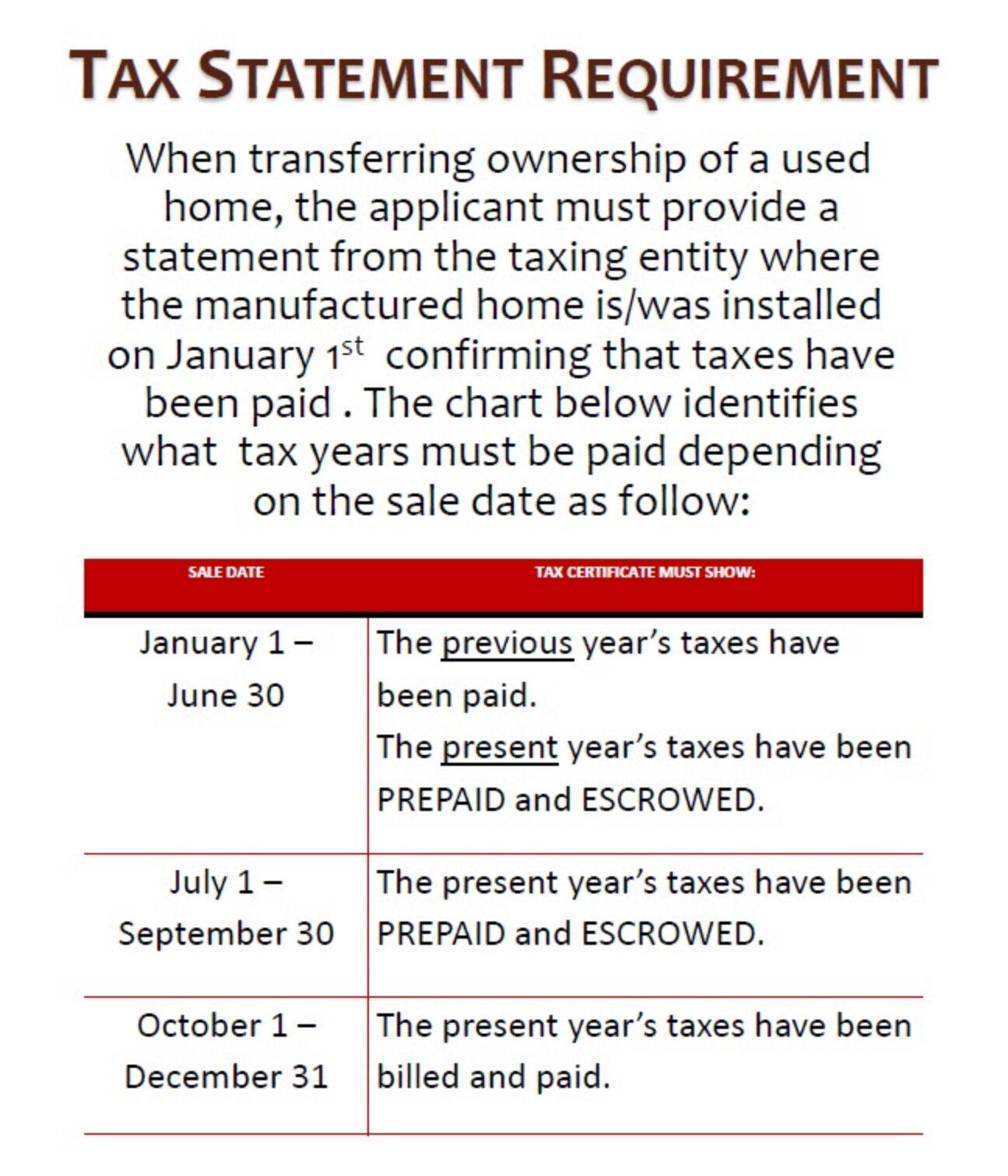

The first thing you need to do if you want to sell your mobile home with a mortgage in Texas is to understand your mortgage. This means knowing the terms of your mortgage, including the interest rate, monthly payments, pay off amount, and any penalties for early repayment. You should definitely find out if there are any prepayment penalties or fees associated with paying off your mortgage early. By understanding your mortgage, you can make informed decisions about selling your mobile home and paying off your mortgage. You also need to understand the process of transferring the title or “Statement of Ownership” out of your name after the sale. That way taxes don’t continue to accrue in YOUR NAME. Keep in mind anytime you sell a mobile home in Texas, mortgage or not, the current years taxes have to be prepaid and escrowed even if taxes are not due yet. The best way we have found to handle this is to prorate the current years taxes between the seller and buyer. This has to be done before the title can transfer out of your name. You will also need a document called a “Release of Lien” showing that the mortgage has been paid off in order to transfer the title. You will need to ask your lender to send it to when paying off the balance. If all of this sounds like a big hassle that you don’t want to deal with by yourself, give us call today to see how we can help! 210-504-8388 ask for Eric or Paul!

2. Determine Your Equity

The second thing you need to do is determine your equity. Equity is the difference between the current market value of your mobile home and the amount you owe on your mortgage. If your mobile home is worth more than you owe on your mortgage, you have positive equity. If your mobile home is worth less than you owe on your mortgage, you have negative equity. If you have positive equity, you can use the proceeds from the sale of your mobile home to pay off your mortgage. If you have negative equity, you may need to come out of pocket to cover the difference, in order to sell your mobile home for less than you owe on your mortgage. Something we see frequently with manufactured homes that have a mortgage is that the seller still owes more than the mobile home is currently worth. This is due to a few factors. If you purchased the home new and added in moving and set up costs to your mortgage then your mortgage was higher than the value of the home itself. Another factor is interest rates. If you are selling your mobile home with a mortgage just a few years after purchase, you have not paid down the principle balance much at all. Most of your payments have gone toward interest but the home has depreciated. Understanding how amortization schedules work on mortgages is very important to grasping this concept.

3. Price Your Property Competitively

One of the most important factors in selling a mobile home with a mortgage is pricing it competitively. If your property is priced too high, it may sit on the market for months without any offers. On the other hand, if it’s priced too low, you may not get the full value of your property. To price your property competitively, you need to consider factors such as the local market conditions, the condition of your property, its age, size, and the features and amenities it offers. You should also take into account the amount you owe on your mortgage and any fees associated with selling your manufactured home.

4. Make Necessary Repairs and Improvements

If you want to sell your mobile home with a mortgage, you need to make sure it’s in good condition. This means making necessary repairs and improvements to ensure that your property is attractive to potential buyers. Some common repairs and improvements include fixing leaks, replacing outdated fixtures, and repainting walls, steam cleaning carpets, pressure washing the exterior. By investing in these improvements, you can increase the value of your property and make it more appealing to buyers. Just be sure not to overspend, you don’t want to cut into your profits.

5. Consider a Direct Sale

If you need to sell your mobile home with a mortgage quickly, a direct sale may be the best option for you. A direct sale involves selling your property directly to a buyer without the need for a real estate agent or listing on the open market. This can save you time and money, as you won’t need to pay agent commissions or deal with the hassle of staging and marketing your property. And by selling your mobile home quickly, you can potentially save thousands of dollars in holding costs like lot rent, utilities, insurance, mortgage payments, taxes, etc. Journey Mobile Homes is a reputable and experienced direct mobile home buyer who can offer you a fair price for your home and close on a sale quickly. By working with Journey Mobile Homes, you can save time and money when trying to sell your mobile home without the hassle of traditional home-selling methods.

6. Work with a Reputable Mobile Home Broker to Sell Your Mobile Home

If you decide to sell your mobile home with a mortgage on the open market, it’s important to work with a reputable licensed mobile home broker. A good broker can help you price your property competitively, market your property effectively, and negotiate with potential buyers. We have a simple 30 day process we use at Journey Mobile Homes to sell mobile homes for owners from time to time. Our first choice is always a direct sale where we purchase the home directly for cash. But in certain situations it makes more sense for us to broker the home. We simply agree to a price, sign a 30 day Purchase and Sale Agreement, then market the home to our list of cash buyers. We take care of showing the home, securing an end buyer, all of the closing paperwork, and there are NO commissions or fees! This can work well if a home needs to be moved and we don’t currently have a lot to put it on or if it doesn’t meet our purchasing criteria st that time but we know we can sell it. We have successfully done this many times and it can be a great strategy. If you have more questions about how this works feel free to give us call anytime at 210-504-8388. We can help you navigate the complex process of selling a manufactured home with a mortgage and ensure that all legal and financial requirements are met.

Selling a mobile home with a mortgage in Texas can be a challenging process, but it’s not impossible. By understanding your mortgage, determining your equity, pricing your property competitively, making necessary repairs and improvements, considering a direct sale, and working with a reputable licensed mobile home broker, you can successfully sell your mobile home and pay off your mortgage. If you’re looking for a fast and direct sale, Journey Mobile Homes can help facilitate the process and offer you a fair price for your home. Or, if you choose to list, our team can help you with that too! Reach out to us today to learn more about how our team can help you with all of your Texas mobile home needs. 210-504-8388!